Freedmen’s Bank, in full Freedmen’s Savings and Trust Company, bank chartered by the U.S. Congress in March 1865 to provide a place for former slaves to safely store their money. After several successful years in which freedmen deposited more than $57 million in the bank, it collapsed in 1874 as a result of mismanagement and fraud. The bank’s failure not only robbed many African Americans of their savings but also had a severe psychological impact on them, causing many to give up hopes and dreams that went along with their savings and bringing about a general distrust of financial institutions for years to come.

The need for a bank for freed blacks became evident during the American Civil War. African American soldiers in the Union army, who were often denied access to conventional banks, were often taken advantage of by swindlers or squandered the pay they received as soldiers. It became clear to some sympathetic military officers, as well as to advocates for civil rights, that African Americans needed a bank to ensure that their money was safe.

John W. Alvord, a Congregational minister, and Anson M. Sperry, a U.S. Army paymaster, individually identified that need and attempted to foster the creation of such an institution in early 1865. Alvord’s efforts culminated in the legislation passed by Congress on March 3 that incorporated the Freedman’s Savings and Trust Company as a nonprofit financial institution. Pres. Abraham Lincoln immediately signed the bill into law. (Sperry began working for the bank shortly thereafter.) According to the charter of the Freedman’s Bank, the money deposited was to be invested in “stocks, bonds, Treasury notes, or other securities of the United States.” Unlike a conventional bank, the Freedman’s Bank was forbidden to make loans. It operated as a sort of cooperative; each depositor owned a share of the bank’s assets in proportion to his or her deposits. A board of 50 white trustees was named to manage the bank’s affairs.

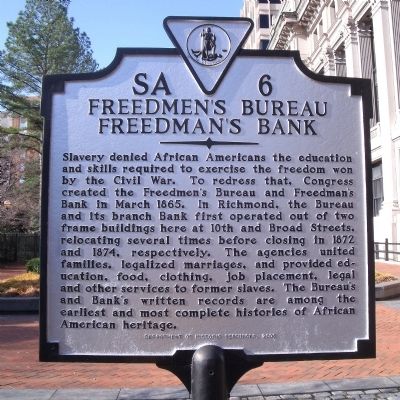

At first the Freedman’s Bank was a success. During the Reconstruction period it opened branches in a number of Southern cities with large black populations—including Richmond, Virginia; Charleston, South Carolina; Savannah, Georgia; New Orleans, Louisiana; Vicksburg, Mississippi; and Houston, Texas. The bank eventually had more than 30 branches in over a dozen states and the District of Columbia as well as about 72,000 depositors. Some individual accounts contained only pennies, but the existence of the accounts showed that freed blacks were trying to get financial security and were planning for the future.

Despite a promising start, however, the Freedman’s Bank was soon in trouble. An 1870 amendment to the bank’s charter changed its loan and investment policy, allowing it to speculate in stocks, bonds, real estate, and unsecured loans. By early 1874 the bank was on the verge of collapse owing to overexpansion, mismanagement, abuse, and fraud. In March of that year, in an effort to reestablish confidence in the bank, its white trustees resigned, and the well-known and highly respected African American leader Frederick Douglass became the bank’s president.

Douglass invested $10,000 of his own money in the bank in an effort to instill confidence in the institution. Within only a few months, however, the grave condition of the financial institution became clear. In June 1874 Douglass recommended that Congress close the bank. The bank collapsed and closed on June 29, 1874, with many depositors losing their entire life savings. The bank’s assets were not protected by the federal government, and Congress refused to reimburse depositors. Many depositors continued to petition Congress for compensation, and eventually about half of them received more than half of their money back. Still, others received nothing.

Although the collapse of the Freedman’s Bank was devastating to thousands of African Americans, the records left behind by the bank have proved an invaluable source for genealogists. The records are the largest single source of lineage-linked African American records known to exist.

.jpeg)